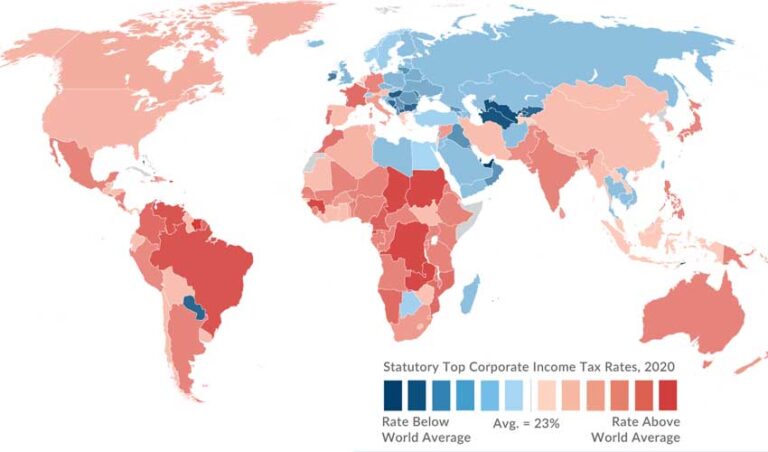

In the world of 2021, the highest corporate tax rate belongs to the United Arab Emirates (UAE), with a whopping of 55%. At the top of the list, we also have Brazil (34%), Venezuela (34%), France (31%), and Japan (30.62%).

The global average corporate tax rate is 23.79%.

On the other side, we have top 10 countries that charge 0% corporate tax:

- Anguilla

- Bahamas

- Bahrain

- Bermuda

- Cayman Islands

- Guernsey

- Isle of Man

- Jersey

- Turks and Caicos Islands

- Vanuatu

From this list, Bermuda, Bahamas, and the Cayman Islands are appealing to many entrepreneurs and U.S. businesses because of their 0% tax rate combined with a simple structuring for setting up an off-shore business.

The Bahamas offer an expanded tax advantage because they don’t tax profits, dividends, or personal income. It also lacks capital gains, inheritance, gifts, and unemployment taxes.

However, there are some tax requirements like business licensing fees and some property taxes, as well as a value-added tax (VAT). In the Bahamas, there are also many incentives for international investors and foreign investors. Foreign investors enjoy a shield of privacy.

The country also offers an easily accommodating framework for setting up business structures that can take advantage of the 0% corporate tax rate.

Bermuda and the Cayman Islands also offer similar international and foreign investing advantages with their 0% corporate tax rate. Together, the Bahamas, Bermuda, and the Cayman Islands are three of the most popular countries for offshore investing, which makes them very appealing to business entrepreneurs and particularly U.S. businesses.

Low Corporate Tax Rates

In addition to the mostly Caribbean countries with no corporate taxes, many countries in Eastern Europe have lower than average corporate tax rates, including:

- Romania 1%

- Hungary 9%

- Montenegro 9%

- Andorra 10%

- Bosnia and Herzegovina 10%

- Bulgaria 10%

- Gibraltar 10%

- Macedonia 10%

- Moldova 12%

- Cyprus 12.5%

- Ireland 12.5%

- Liechtenstein 12.5%

- Albania 15%

By comparison, Europe has the lowest corporate tax rate at 19.35%, lower than the average tax rate in Asia (21.09%), the Americas (27.21%), and Africa (28.24%).

Where the U.S. stands

With the Tax Cuts and Jobs Act (TCJA) of 2017, the U.S. corporate tax has been slashed from 40%—the second highest in the world as of 2017—to 21% in 2018, below the global corporate tax rate average of 23.79%. The decrease in the U.S. corporate tax rate is one of the most dramatic decreases in any country since the beginning of the 21st century.

Gambling Consulting Expert offers consultancy services and complete package solutions for gambling license acquisition that include:

- Gambling jurisdiction and business advisory

- Gambling business corporate structure incorporation

- Opening bank accounts

- Gambling license application

- White Label or TurnKey Software Solution